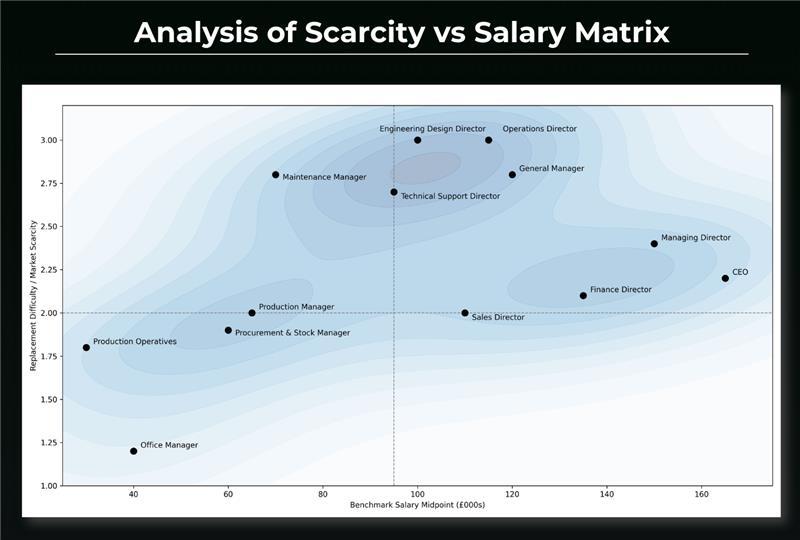

Scarcity vs Salary heatmap for engineering and tech roles – North of UK

The Uncomfortable Truth About Engineering Talent: Paying More Won't Save You

There's an assumption that runs through most boardroom conversations about recruitment: if we're losing people, we probably need to pay them more.

It's a reasonable instinct. It's also increasingly wrong.

Our latest market research — drawn from live employer hiring data, regional salary surveys, competitor recruitment activity and real placement intelligence across the North of England — tells a more complicated story. And if you're a hiring manager, HR lead or business owner in engineering or manufacturing, it's one worth sitting with.

The roles most at risk aren't the highest paid ones

The data is clear: the hardest roles to replace right now aren't at the top of the salary scale. Maintenance Managers, Operations leads, and technical supervisors sit in what we'd call high-scarcity zones — thin candidate pools, long time-to-hire, and multiple employers chasing the same small group of people. Simultaneously.

Meanwhile, engineering wages are growing at 6–7% year on year. Labour shortages have been cited by the CBI as the single biggest constraint on business. And over 25% of the UK manufacturing workforce is now aged 50+, with apprenticeship starts still below pre-2019 levels.

The pipeline isn't filling up. The pressure isn't going away.

So what actually drives people to leave — or stay?

Our research consistently shows that churn in technical and operational roles is linked far more to workload intensity, lack of career progression, and feeling undervalued than to base salary alone. Competitors aren't just outbidding you on pay — they're offering clearer next steps, more stable pipelines of work, and better day-to-day environments.

Pay matters. Of course it does. But it's rarely the whole story, and in tight candidate markets, a £5k uplift rarely wins the war on its own.

What this means for your hiring strategy

The businesses navigating this best aren't reacting — they're planning. They know which roles carry the highest replacement risk, they understand what the market is actually paying (not what they assume it's paying), and they're thinking about retention before the resignation lands on the desk.

That's exactly the kind of intelligence we work to provide.

If you'd like to understand how your business sits within the current market — or where your real exposure lies — we'd be glad to have that conversation.